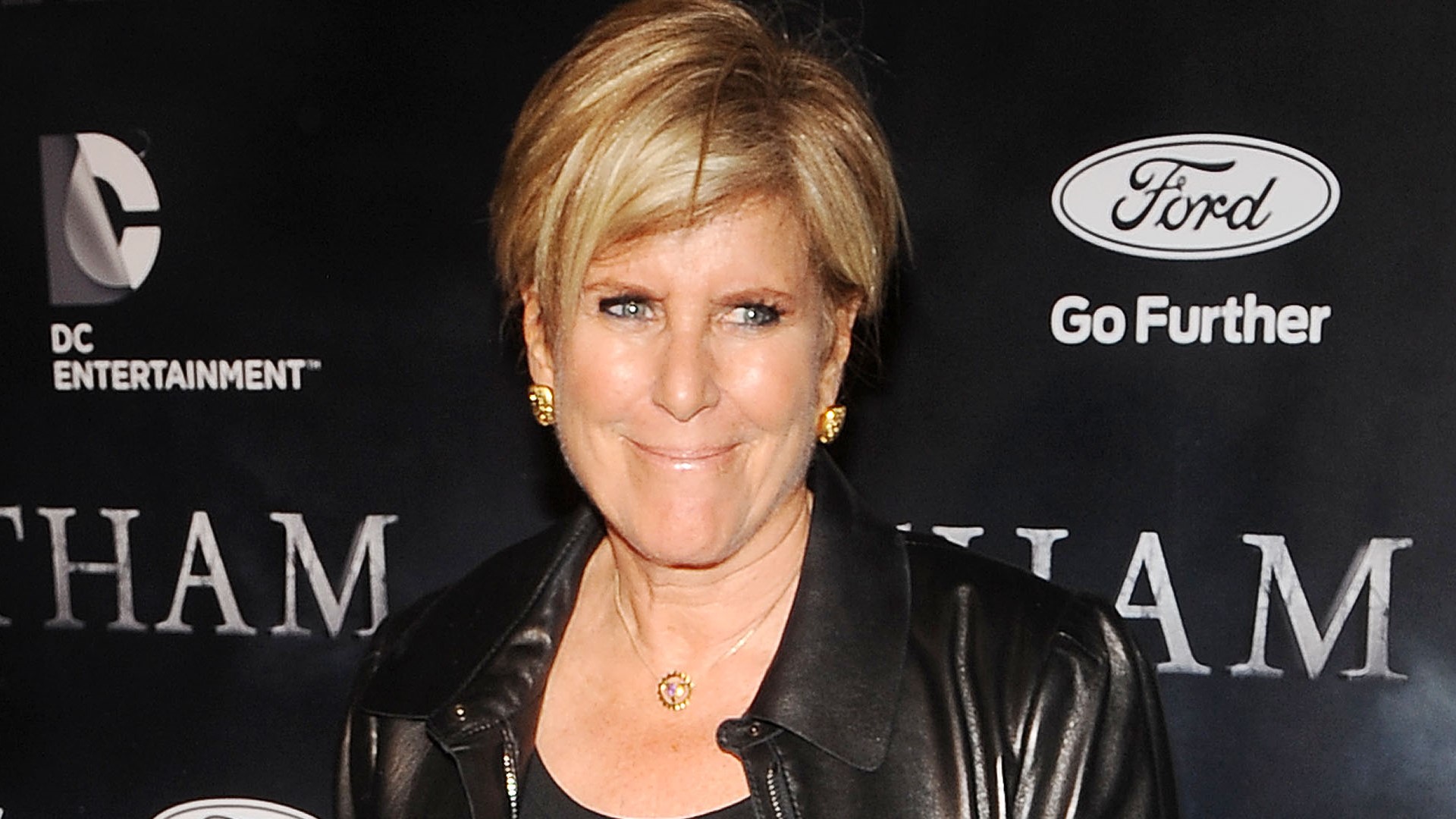

No Duh: Suze Orman on Why Parents Shouldn’t Be Paying Their Adult Kids’ Phone Bills

The Bank of Mom and Dad: When to Close the Doors and Foster Financial Independence

Many parents find themselves in a familiar situation: their adult children are still relying on them for financial support. While the instinct to help your offspring is natural, personal finance expert Suze Orman argues that continuing to foot the bill for adult children, even for seemingly minor expenses, can hinder their journey to financial independence.

Why Letting Go is Crucial

Orman emphasizes that parents need to resist the urge to bankroll their adult children’s lifestyles indefinitely. This doesn’t mean abandoning them entirely, but rather shifting the focus from providing a constant safety net to fostering financial responsibility. The reasoning is simple: managing even small bills builds a foundation for sound financial habits.

“If it’s a manageable amount, it won’t be hard for them to take on. And that’s a key step toward financial independence,” Orman has stated. This includes things like phone bills, streaming subscriptions, and car insurance. By taking ownership of these expenses, young adults learn to budget, prioritize, and make informed financial decisions. Furthermore, successfully managing these bills can be a stepping stone to establishing good credit. Setting up automatic payments, for example, helps build responsible habits and a strong credit score, crucial for future financial endeavors.

Goal-Oriented Financial Assistance

While cutting off financial support entirely might seem harsh, especially if a young adult is struggling, Orman suggests a more nuanced approach. She doesn’t necessarily discourage parents from providing financial assistance altogether, but believes it should be strategically structured to help their children develop essential financial skills.

One effective method is to encourage adult children who have moved back home to contribute to household expenses. This doesn’t necessarily mean charging them full market rent, which they likely couldn’t afford anyway, but establishing a consistent “rent” payment, even a smaller one, can instill financial discipline and a sense of responsibility.

Consider this scenario: if parents don’t actually need the extra income, they could set aside these “rent” payments and return them to their child later as seed money for an emergency savings account. This not only teaches budgeting but also provides a tangible reward and a head start on building financial security.

The Importance of Prioritizing Your Own Retirement

As children transition into adulthood, parents are often approaching a critical juncture in their own lives: retirement. It’s crucial to remember that securing your own financial future is paramount, and continued financial support for adult children can jeopardize those plans.

Orman stresses that while fostering financial independence in your children is important, parents must remain laser-focused on their own financial goals, particularly retirement planning. Think of it as a shift in priorities. Just as your adult children are embarking on their own journey of self-discovery and independence, you have earned the right to focus on your own well-being and secure your future. Maintaining the “Bank of Mom and Dad” indefinitely can drain resources that are essential for a comfortable and secure retirement.

Practical Steps to Encourage Financial Independence

Here are some actionable steps parents can take to encourage financial independence in their adult children:

- Gradually transfer financial responsibilities: Don’t cut off support cold turkey. Start with smaller bills and gradually increase their responsibilities as they demonstrate financial competence.

- Encourage budgeting and tracking expenses: Help them create a budget and track their spending habits to identify areas where they can save money. There are numerous apps and online tools that can simplify this process.

- Openly discuss finances: Have open and honest conversations about money, budgeting, and financial goals. Share your own experiences and lessons learned.

- Offer guidance, not handouts: Instead of simply giving them money, offer guidance and support as they navigate financial challenges. Help them research options, compare prices, and make informed decisions.

- Encourage saving and investing: Teach them the importance of saving for the future and investing wisely. Explain the basics of compound interest and different investment options.

- Set clear expectations: Communicate your expectations clearly and consistently. Let them know what expenses you are willing to cover and for how long.

- Lead by example: Demonstrate responsible financial habits in your own life. Show them how you budget, save, and invest.

By taking these steps, parents can help their adult children develop the financial skills and habits they need to achieve long-term financial independence and security.