Buffett Estate Battle: Widow’s Inheritance at Risk

The legal battles unfolding over the estate of the late Jimmy Buffett offer valuable insights into the complexities of estate planning, even for those with seemingly airtight wills and trusts. The dispute highlights the critical importance of selecting the right individuals to manage assets after death and clearly defining the circumstances under which they can be removed.

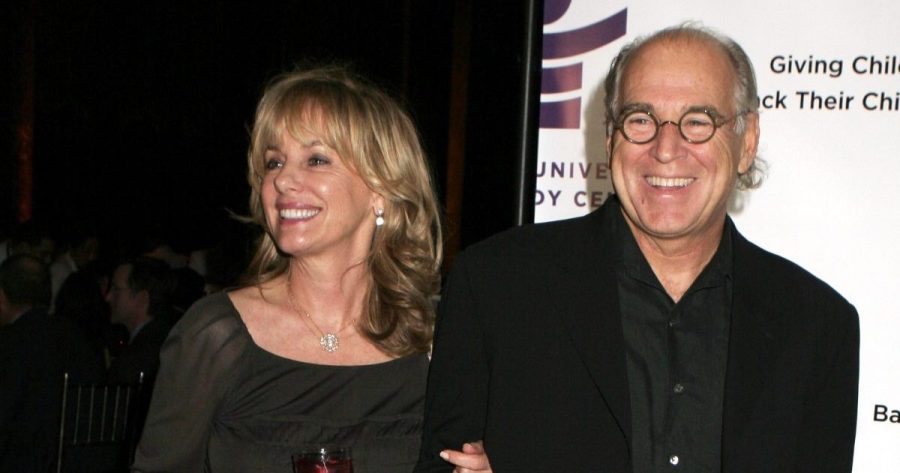

Buffett, the singer and entrepreneur behind the Margaritaville empire, passed away in 2023 at the age of 76. His will stipulated that his considerable fortune be placed in a trust. He appointed his widow, Jane Slagsvol, and his long-time financial advisor, Richard Mozenter, as co-trustees to manage the trust. However, by June 2025, both Slagsvol and Mozenter had filed petitions in Los Angeles and Palm Beach, Florida, respectively, seeking each other’s removal as trustee. The outcome of this legal fight will determine who ultimately controls Buffett’s $275 million estate.

The Buffett Estate: A Breakdown

Buffett’s estate encompasses a wide array of valuable assets, including:

- Intellectual Property: Royalties from his hit songs such as “It’s 5 O’Clock Somewhere,” “Oldest Surfer on the Beach,” and “Cheeseburger in Paradise,” which continue to generate approximately $20 million annually. His albums have sold over 20 million copies worldwide.

- Personal Assets: A yacht, real estate holdings, airplanes, luxury watches, and valuable securities.

- Business Interests: A 20% stake in Margaritaville Holdings LLC, the brand management company he co-founded with Slagsvol. Margaritaville boasts a portfolio of 30 restaurants, 20 hotels, vacation clubs, casinos, cruise ships, and a thriving merchandise business.

The Trust Structure

Buffett’s trust was designed to provide for his widow, Jane Slagsvol, for the remainder of her life. As a trustee, Slagsvol receives all income generated by the trust. She is also entitled to additional funds for healthcare, living expenses, and “any other purpose” deemed to be in her best interest by the independent trustee – a role held by Mozenter as of July 2025.

Separate trusts were also established for Buffett’s three children: Savannah, Sarah “Delaney,” and Cameron. Each child reportedly received $2 million upon their father’s death. Upon Slagsvol’s passing, she has the authority to designate who will inherit the remaining assets from among Buffett’s descendants and charities. This type of estate plan, common among wealthy married couples, aims to ensure the surviving spouse’s financial security while simultaneously safeguarding the inheritance for children and grandchildren, even if the spouse remarries. Critically, these types of trusts are typically difficult for the surviving spouse to alter without court approval.

The Trustee Dispute: A Clash of Wills

The legal battle centers around the conflicting desires of Slagsvol and Mozenter to control the trust. Slagsvol is seeking to remove Mozenter as the independent trustee. Her allegations against him include:

- Refusal to provide requested financial information.

- Failure to cooperate as a co-trustee.

- Hiring a trust attorney who allegedly pressured her to resign as trustee.

- Raising concerns about the trust’s income projections and Mozenter’s compensation.

Mozenter’s petition, filed in Florida, alleges that Buffett harbored concerns about Slagsvol’s ability to manage his assets after his death. He claims that Buffett established the trust to prevent her from having direct control over the assets.

Estate Planning Lessons: Choosing Wisely and Defining Boundaries

The Buffett estate dispute offers two crucial lessons for anyone engaged in estate planning:

1. The Importance of Selecting the Right Fiduciary:

Choosing the right person to manage your assets after death is paramount. Consider the following options:

- Professional Executor or Trustee: A neutral professional may be better equipped to handle family disputes but can incur significant fees.

- Relative or Trusted Friend: This option can be cost-effective, but it’s crucial to assess their ability to manage the estate and their relationships with other beneficiaries. Many wills designate an adult child or grandchild as the executor.

- Hybrid Approach: Combining a professional and a family member can provide a balance of expertise and personal knowledge.

Regardless of the choice, ensure that the chosen individuals can cooperate effectively with each other and with all potential heirs.

2. Clearly Define Removal Circumstances:

It’s essential to explicitly state the conditions under which a trustee can be removed. Courts are generally hesitant to remove a trustee without evidence of negligence, fraud, or disloyalty. However, removal may be warranted if a breakdown in cooperation hinders the administration of the estate or trust.

Some trusts include provisions allowing beneficiaries to replace a professional trustee with another professional, which can resolve disputes without resorting to costly court battles.

By proactively addressing potential conflicts and clearly outlining the roles and responsibilities of trustees, individuals can help prevent the kind of expensive and public litigation currently surrounding Jimmy Buffett’s estate. Careful planning and thoughtful selection of fiduciaries are essential for ensuring a smooth and equitable transfer of wealth and preserving family harmony.